Central to arguments in favor of state control over local planning and landuse decisions is the claim that increasing housing supply trickles down and increases the affordability of existing units. In his new book, Sick City: Disease, Race, Inequality, and Urban Land, author Patrick Condon, Chair of the Urban Design program at the University of British Columbia, harkening back to 19th century political economist, Henry George, explicitly articulates how increasing density without affordability only further inflates urban land values to the benefit of speculators, resulting in nearly all of the value of individual labor and creative enterprise of entrepreneurs in regional economies to be absorbed as land wealth. Condon offers solutions for disciplining land markets and correcting land value inflation citing Cambridge, Massachusetts' 100% affordable housing overlay and other regulatory mechanisms in Portland and Vienna for ensuring permanently affordable housing supply. TPR below shares a presentation by Condon from a recent Livable California townhall providing an overview of his book, a full creative commons copyright version of which can be found online, here.

Patrick Condon

“But unfortunately, in all the cases that I've examined throughout North America, what happens when you do a rezoning is you let the hungry dogs of land price speculation and inflation loose across the landscape with the intention of enhancing affordability.”—Patrick Condon

Patrick Condon: Vancouver is really famous for putting a lot of housing in their downtown, and I and my colleagues were enthusiastic about what that did for the downtown. I am basically a pro-density guy; my earlier books are all about the advantages of density and what it does to promote walkability, diversity, potentially diversity of incomes, and access to commercial services and so forth to make for a more sustainable city.

However, the one thing that [density] hasn't done in Vancouver is make housing more affordable. I was disappointed to come to that recognition myself over the years. I had to reverse my opinions about whether in adding density you create a situation where housing is more affordable. I reluctantly concluded that that wasn't the case and is going to be the central issue of my discussion today.

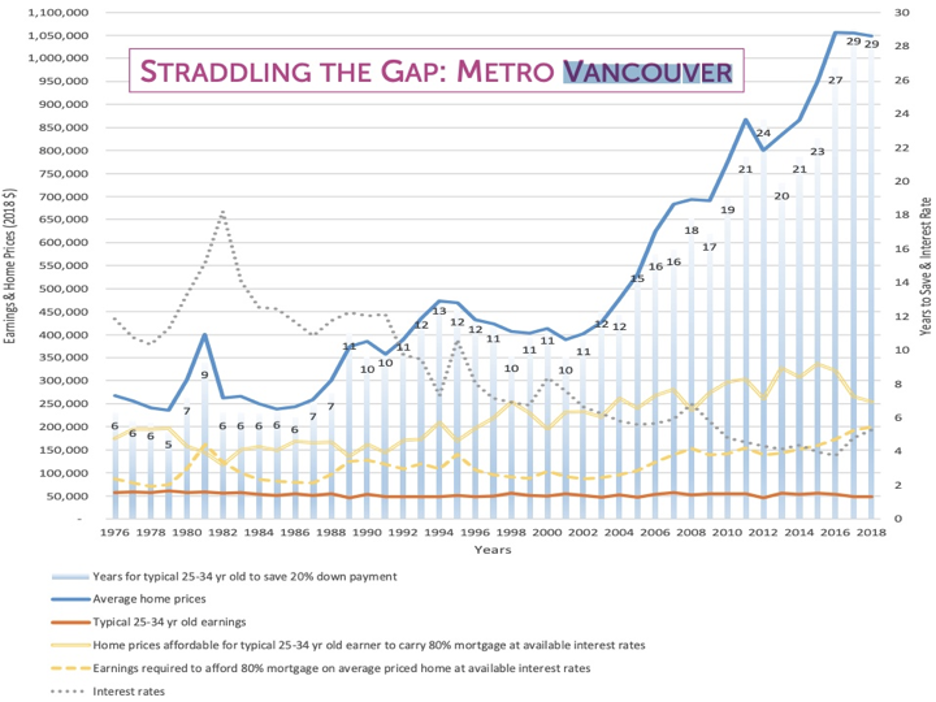

Because in Vancouver, during this period of great density increases throughout the city and particularly in the downtown prices kept climbing. The graph below makes it abundantly clear with the blue line, indicating the number of years that the average wage earner would have to save in order to afford the average house in the city of Vancouver just since the 90s.

So, in my academic career, I started to do some real soul searching and investigation of why that might be is all compiled and this book, Sick City: Disease, Race, Inequality, and Urban Land, which charts how marginalized communities and the younger generation are not only disadvantaged in terms of their precarious access to housing, but they're also disadvantaged in terms of their additional exposure to COVID, diseases, and other pandemics because of issues that relate to housing, such as crowded housing, which the Bay Area and Los Angeles have a real problem with right now. It's not density that's the problem; it’s not how many units there are in your neighborhood; it's how many people there are in your unit which turns out to be the vector.

The fact that endangered people in crowded apartments tend to live in neighborhoods with other people that are in crowded apartments, and they see each other on the streets and serve each other at the grocery stores, at the cafes, and so forth, is the real problem. The exposure to the community which has these issues which are fundamentally rooted in unequal access to affordable housing explains the real disparity between people who live in other neighborhoods who have access to affordable housing or have lived in those houses for a long time versus people who have not. So, that's the nature of the book and underlying the book is this idea that it's really housing that is driving a lot of issues of inequality and most recently, inequality in terms of its effect on the transmission of the pandemic.

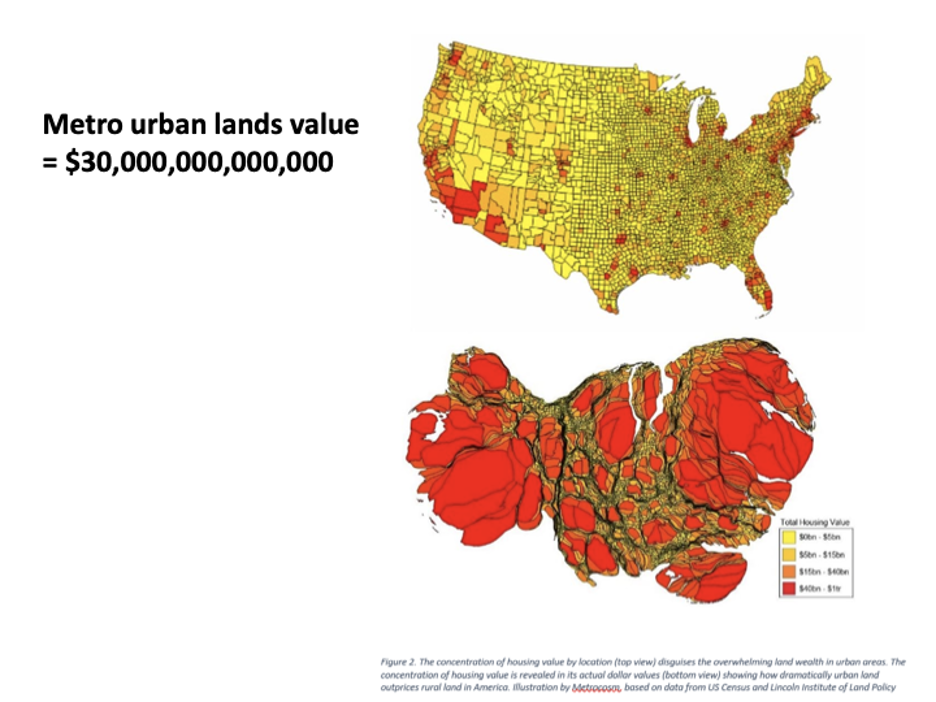

Underlying all this is something that people are really not familiar with, and it's no surprise, because I wasn't familiar with it before I started to do this investigation some 10 or 15 years ago. The real driver is not the price of the house; the real driver is the price of the land underneath the house. It's land price inflation in the United States and around the world, that is the real problem, particularly in our urban areas, and California is sort of the poster child for inflated land values. In this image, the deeper red you are, the higher the cost of that land. The top map underrepresents the reality in terms of geographic areas. But if you explode those up to a scale that shows how much they actually represent in terms of the total land value of the United States, you see that this is an incredible phenomenon of land price inflation.

This is a very relatively recent phenomenon, basically since 2008, when we recovered from the last property crash. Basically all of California sucking up about a fifth of total land value in the country, whereas you have the northeast corner and taking up another quarter and Florida some more. Here's the value of urban land in major metropolitan areas in the country.

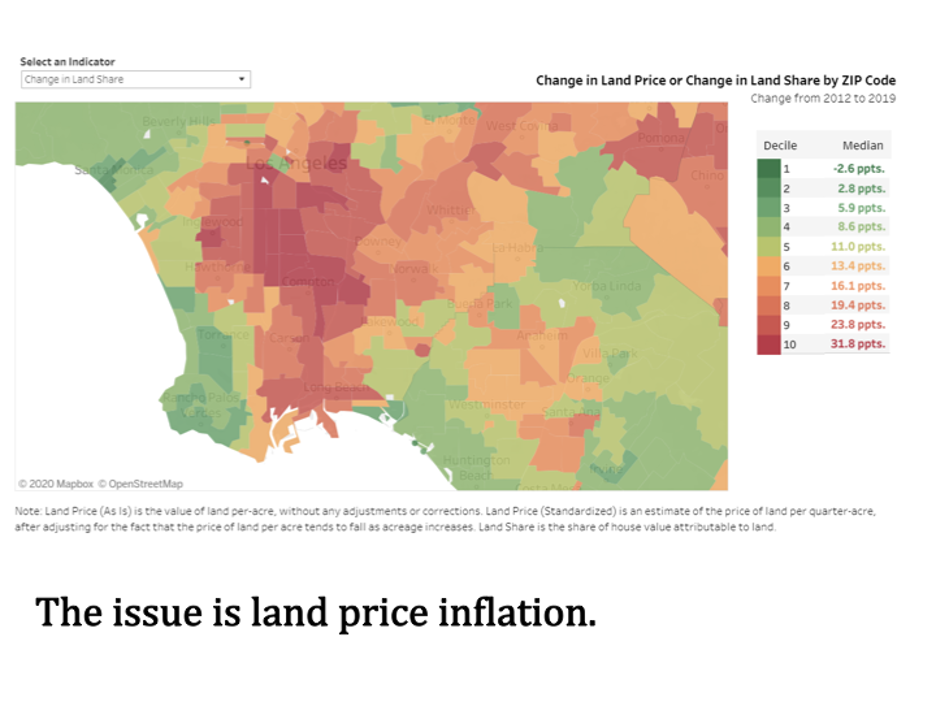

This particular map shows, just in the LA Basin, that the land portion of real estate has been an increasing portion of the total real estate value of any particular parcel. It’s important to make the distinction between the land value and the building value. This map shows you that the land value—where it's the darker red—has been going up, such that it's an increasing percentage of the total value of what's on the parcel.

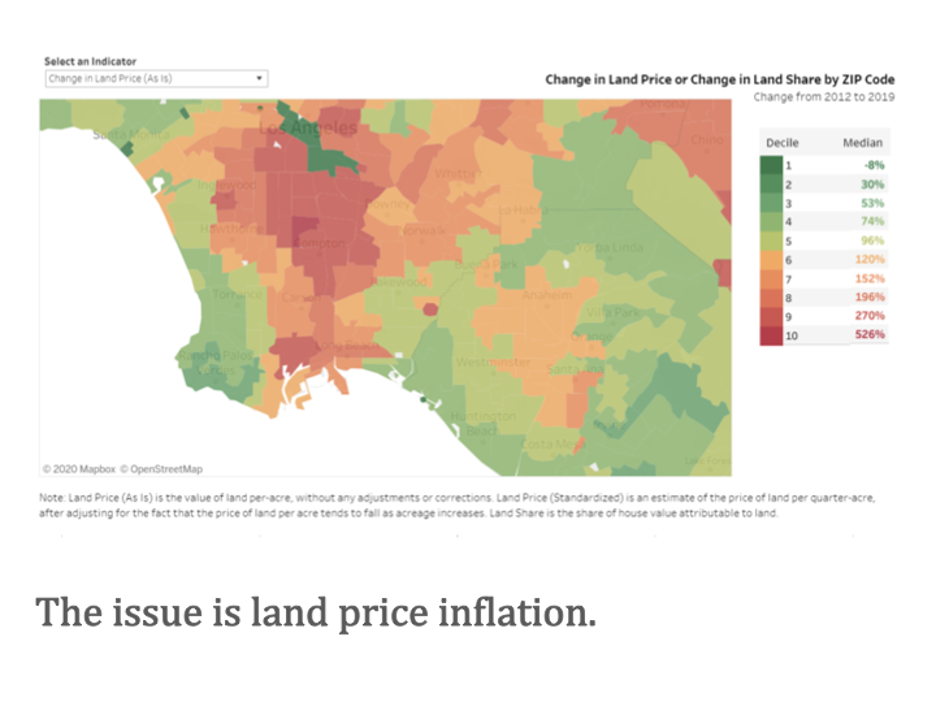

The next one I think is more dramatic, showing you that in this part of the LA basin—which tends to correlate with parts of the LA basin which previously had the most affordable housing—now is suffering under the situation where the land component—the change in land price—has increased, just in seven years, by 500 percent.

I hope that this proves to you that the real problem—something that really ought to concern us all—is the inflation of land value and not the cost of building the building itself. The cost of living has only gone up marginally. You can still build a wood frame building in metropolitan areas for a couple hundred dollars per square foot. But, in metropolitan areas, the value of the land per square foot of approved density when you build out can be anywhere from $500 to $1,200 per square foot, and that's a very recent phenomena.

Lo and behold, when I was doing this investigation, I discovered San Francisco native Henry George. Henry George, in my world and among the people that I'm talking to, is making a bit of a comeback. During his lifetime he was more famous than Mark Twain. His influence on global economics was greater than Karl Marx, and it's incredible that we've almost forgotten this fellow because he had incredible insight that really relates to what we're talking about today.

His insight came from living in San Francisco and traveling to New York, on occasion. At first, he couldn't figure out why it was that in New York in the late 1800s—obviously a very wealthy place—also exhibited poverty. There were beggars and homeless people on the street, as we are living with now and can't figure out why or what to do about it. He asked the question, "why is it that New York with all this wealth has so much obvious poverty, and San Francisco doesn't?" In the late 1800s, San Francisco did not have any evidence of poverty, and from this he developed the hypothesis that as a city grows wealthy, it produces poverty.

Asking the question, "why would that be?", he said, it turns out that as cities mature, the value of individual labor, as well as the creative enterprise of entrepreneurs, gradually becomes absorbed in the price of land—what he called land rents—to the point where almost all of the value of individual labor in the economy of a region and the creative enterprise of entrepreneurs is absorbed into land wealth. He explained this in his book, Progress and Poverty, which for a decade, sold more copies than the Bible in the United States and was translated into 20 different languages. He was, as I mentioned before, far more influential for this idea, which really captured the imagination of a lot of people around the world, than was Karl Marx, Adam Smith, or any other economists.

I like him a lot because he taught himself. He was what we call an autodidact. He didn't have any training in economics; he just did this through his observation and became so influential around the world. It's tragic that we don't really remember him very much in the American conversation about real estate because he was so important. There's a longer sub-story about why his influence became diminished, and that story has to do with the conscious intention of the land barons during the late 1800s to argue against him. They set up academic institutions like Columbia University and the Chicago School of Economics, which were specifically funded to argue against his principles because they would endanger the wealth of so-called land barons.

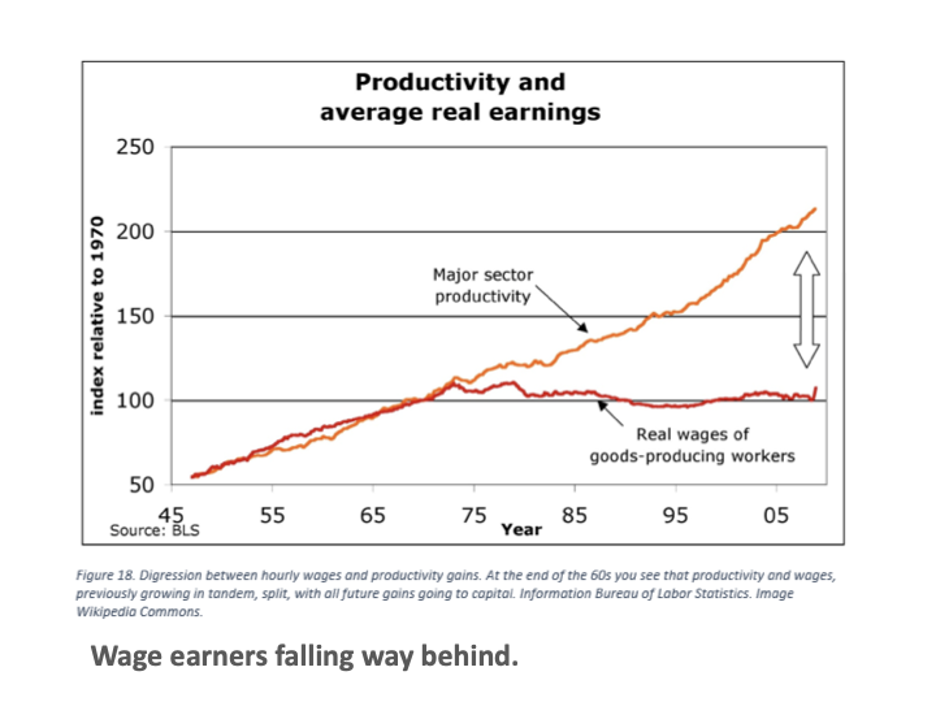

This is about where we are as a nation and as a world—this applies to Canada, the United States, and to most advanced economies. We're now living in the moment where average wages have separated from productivity quite dramatically. Up until the 1970s, when productivity increased, wages also increased and that had an influence on access to housing. Baby Boomers, of which I am one, were lucky enough to enter the housing market right around this time. Unfortunately, our children and grandchildren are in this period where the gap between what we contribute to productivity and what is returned to us in wages has separated a lot. What happened to all that value? If you accept what I've said about Henry George, all or much of that excess value gets absorbed into land price, which is my argument here today.

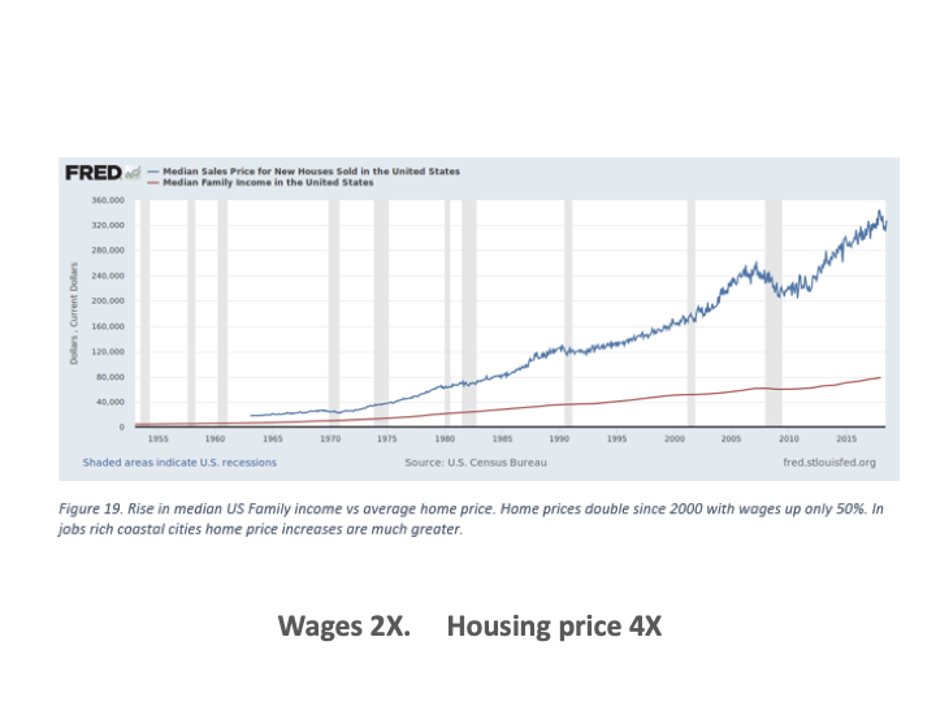

How is that evidenced? Well, here's the obvious graph that shows you from the 1960s to contemporaneously, the blue line is average home prices throughout the United States against average wages. You can see that there's been a 200 percent increase in the average home price across the nation, not just California, that has not kept up with wages. This is something that we know, but it's instructive to see it in terms of a graph.

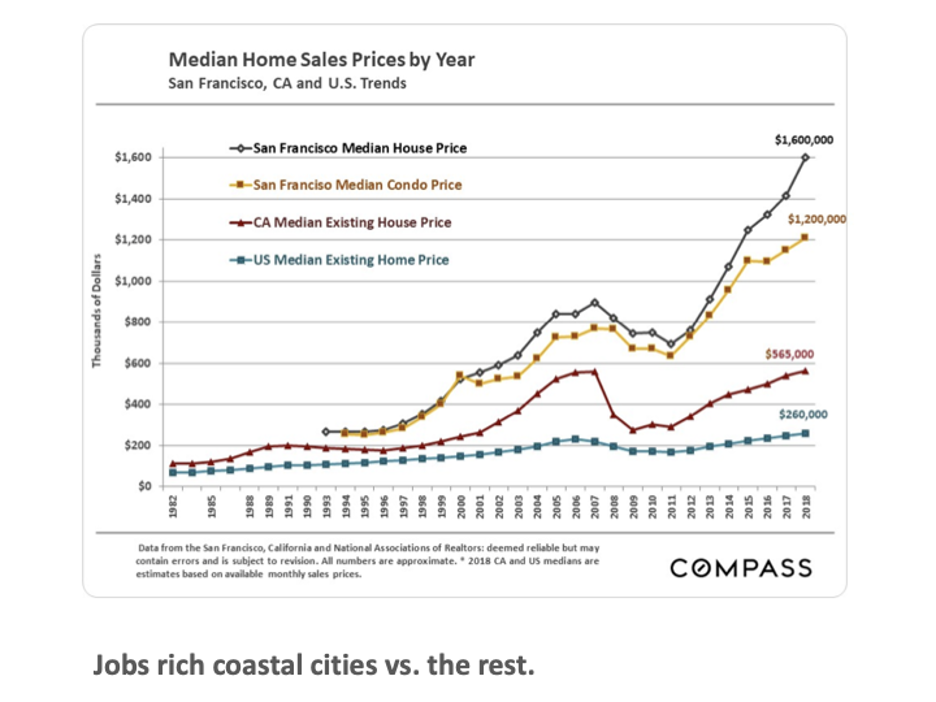

When you hone in on poor California, the graph becomes far more dramatic and terrifying. This is that same line showing you the increase in home prices nationally. It shows the California median and existing home price—with a big bump there in 2008—but the San Francisco median condo price and the San Francisco area median house price is more than alarming; it's shocking, tragic, and a disgrace to the human race.

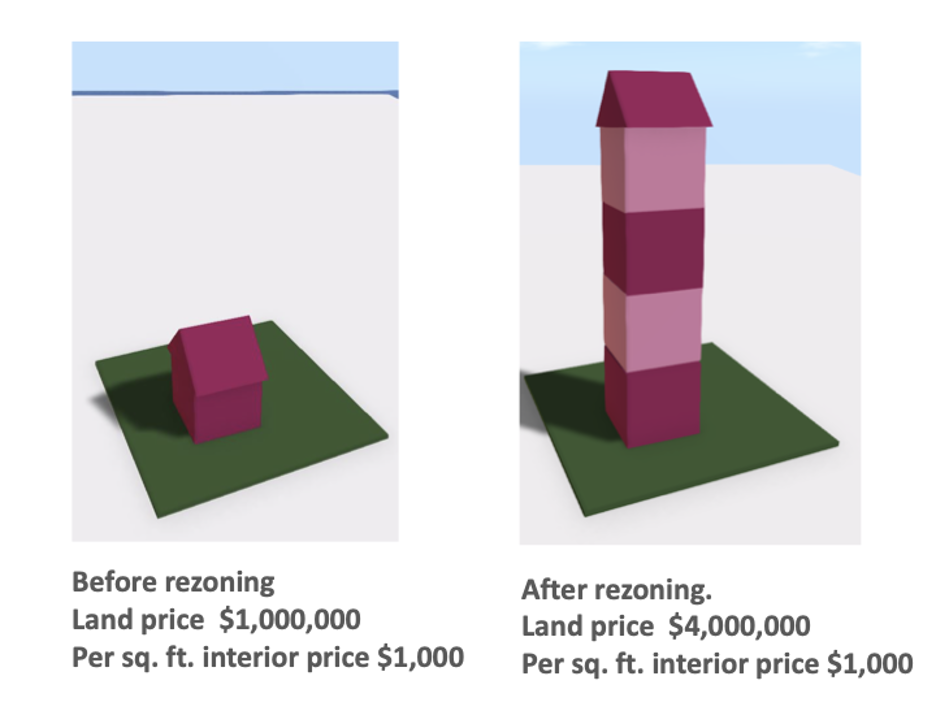

In Vancouver, California, and almost every place I've discussed this, it's very frustrating for me having looked at this so carefully, to come up against the presumption that all of this would be cured if only we could add additional density. On the left, you see a very simple diagram of a single-family home before rezoning land price, per million dollars per square foot, with an interior price of $1,000 per square foot, roughly. Those are simple numbers to get your head around. We think that if we would quadruple the density, the price per square foot of interior price should go down to below $500, or $300 per square foot if we're lucky, which would bring it back to affordability. But unfortunately, in all the cases that I've examined throughout North America, what happens when you do a rezoning is you let the hungry dogs of land price speculation and inflation loose across the landscape, which undercuts the intention of enhancing affordability.

Unfortunately, authorizing new density doesn't really help. What it does is increase the land price prior to the building of this new building. At the end of the day, the price per square foot of interior space stays roughly the same, because the market for real estate is governed not by the price of the land, but by how many square feet you can put on the land. If you increase the number of square feet that the public sector allows to go on a parcel of land by a factor of four, you're going to come close to increasing the purchase price of that land by a factor of four with no benefit to the presumed beneficiaries, which would be the people you want to house.

This is not a new problem. This has happened around the world, and various countries and periods in history have tried to deal with it in various ways. The most successful of them was Vienna, which had a similar issue of overcrowding and very inflated land price. There's not time for me to explain all the reasons why, but at the end of World War I they found themselves in a situation where it was so crowded in Vienna and the prices of homes and rents were so high that people were actually renting out space during the day for the night shift to sleep, so someone could come in and sleep in your own bed during the day.

In the 1920s to now, they could have built a lot of public housing but they realized that that wasn't going to work. What they did instead was, inspired by Henry George, put a tax on the most expensive dwellings in the city—which were basically all apartment buildings—and that did two things. The high tax on high value properties tended to reduce their value and undercut the value of urban land for that kind of property development in the market.

They lowered the price of developable land through that tax, and then they took the money from that tax and went back into the land market and bought land for non-market housing at the rate that they had reduced. They successfully reduced the inflationary pressures on land value through their tax strategy, such that today they have over 50 percent of the people who live in the city of Vienna live in non-market housing.

And, interestingly, because the non-market housing sector is so large—over 50 percent—it has the effect of mitigating inflationary pressures on market housing. So, if you want to buy a condo that's a market condo in Vienna, it's a fraction of the price of a similar condo in Paris, which didn't have this strategy, so rents are much cheaper given that you can choose a non-market housing unit that is much cheaper instead. I use the phrase non-market housing because it's more inclusive than the phrase "public housing" or "housing projects," which have a bad legacy in the United States. There, it's usually nonprofit housing corporations or co-op associations that have provided the bulk of this non-market housing.

What can we do today? I was talking before this discussion started about the withdrawal of money coming from the state towards the provision of affordable housing—public housing, if you will—which exacerbates the problem, and I agree with that. It's necessary now, given the level of this crisis, for the public sector to play a role in many ways, one of them is to provide funding. On the other hand, there is a possibility, or a probability, that if the public sector comes into the land market with many tens of billions of dollars necessary to fix this problem, those taxpayer dollars are going to go largely to the pockets of land speculators. They will feed the beast rather than reducing the problem.

I favor strategies that are initiated at the local level, that are patterned on the ideas that Henry George initially put out there and that were taken up by Vienna, which is to attack the problem where it exists. The problem is the price of urban land, and there are many planning actions that are actually constitutionally legitimate ways to do this in the United States. There are various strategies, which I outline in my book, to use the ordinary planning tools of development taxes and zoning controls to manage the price of land and to stream what would otherwise be speculative value increases into social benefit.

And the social benefit we're all interested in is obviously housing our sons and daughters and people who want to live and work in our cities.

So. the example that I will provide for you is Cambridge, Massachusetts, which only a few months ago, came up with a strategy that I would recommend called an affordable housing overlay, which covers the entire city and doesn't change the existing zoning. It says, if you want to have a density increase, you can do that, but only in return for ensuring that 100 percent of that new housing is affordable forever pegged to medium income levels. So, there have to be housing agreements, a nonprofit housing provider, or something like a home housing Co-Op that would be willing to make that guarantee. And if they guarantee that, they would get the additional density. Now, why is that important? It's important because such a strategy disciplines the land market, and this idea of disciplining the land market is my key message.

Right now, we're not successfully disciplining the land market. We're basically saying, in the case of the California law that you're concerned about, we think that if we add additional zoning, that will solve the problem—that's not disciplining the land market; that's basically feeding the inflationary pressures on urban land value. When you do that, you have signaled to the land market that the value of this land is going to go up and up and up, and certainly, it does. The evidence that I've shown today suggests that is the case, and that by adding density you cannot provide enough—and this is a fundamental point— I have come to believe that there's no way possible under present global economic circumstances for you to overwhelm demand for land value with new housing supply on that land.

The evidence in Vancouver is very strong in this respect that adding supply, which is really increasing the capacity of land to hold that supply, only increases land value to the benefit of land speculators.

- Log in to post comments